Template Community /

1031 Exchange Timeline

1031 Exchange Timeline

Community Helper

Published on 2022-04-06

Introduction

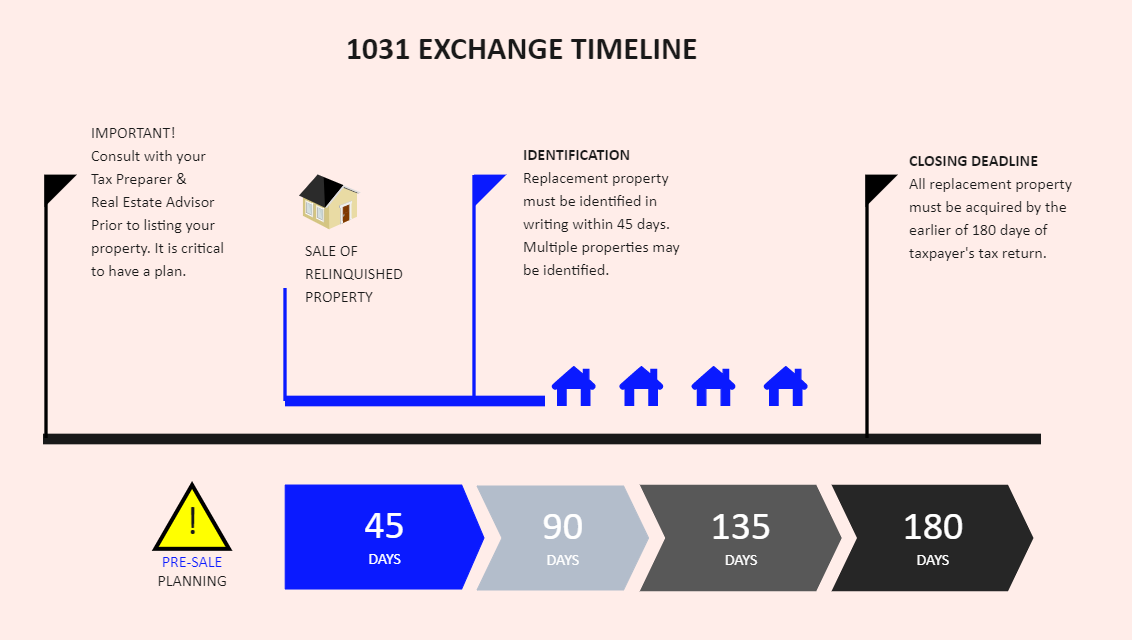

The 1031 exchange timeline represents the process that runs behind the 1031 exchange concerning real estate. The fundamental concept of a 1031 exchange is that you, as a real estate investor, are selling an investment property and go ahead in re-investing in a similar kind of ‘like-kind property.

Thus, you are selling a property and buying another of more or less the same valuation with the leads. The 1031 exchange timeline below guides you with the flow of the complicated process involved in a 1031 exchange deal.

Keep reading to learn about the entire 1031 exchange process shown in a simple manner in the below 1031 exchange timeline.

Understand the 1031 exchange timeline

For every real estate investor, it is essential to know about the process of 1031 exchange, irrelevant of the matter of its complicacy. A 1031 exchange timeline designed to guide all the investors. Especially those who are looking for a simplistic approach in explaining the complex procedures involved. The steps involved are

1031 exchange timeline

Identification: Replacement property must be identified in writing within 45 days. One can identify multiple properties.

Sale of the relinquished property

Closing Deadline: All replacement property must be acquired by the earlier of 180 days of the due date of the taxpayer’s tax return.

Important: Consult with your Tax Preparer and Real Estate Advisor before listing your property. It is critical to have a plan.

How to create a 1031 Exchange Timeline using EdrawMax Online

Creating a 1031 Exchange Timeline diagram in EdrawMax Online is pretty simple. The free Timeline Diagrams maker has several features as you can instantly import the images or icons from your system or Google Drive or DropBox. The 1031 Exchange Timeline Diagram maker lets you import the data right from the .csv file, or you can also import media content, like images, icons, or symbols, right from your Google Drive or DropBox.

Login EdrawMax Online

Log in EdrawMax Online using your registered email address. If this is your first time accessing the tool, you can create your personalized account from your personal or professional email address.

Choose a template

EdrawMax Online comes with hundreds of free diagram templates. Select a pre-designed template by entering the Keyword in the "Search" section or exploring different diagram sets. In this case, you will find the Timeline Diagram under the "Basic Diagram" section under the "General" diagram types. Alternatively, you can simply click on "+" in EdrawMax Online canvas to create a diagram of your preference.

Work on your research

There are situations where professional guidance is required while 1031 exchange is carried out. For example, not always the term ‘like-kind property is clear to be met or, the fact, that high-dollar tax breaks. In such cases are closely monitored by IRS. While drawing your 1031 Exchange Timeline diagram, remember these things.

Customize the diagram

Customize your timeline diagram by changing the color or by adding more relevant data. Based on your research, you can also add or remove the data accordingly. Since it is about product planning, you can add more relevant data about different products and include their lifecycle.

Export & Share

Once your required timeline diagram is completed, you can share it amongst your colleagues or clients using the easy export and share option. You can further export the diagram in multiple formats, like Graphics, JPEG, PDF, or HTML. Also, you can share the designs on different social media platforms, like Facebook, Twitter, LinkedIn, or Line.

Important Tips

Nine critical steps in the 1031 exchange process can be part of the 1031 exchange timeline.

Identify the property you are going to sell.

Selecting a QI.

Adding to the contract offer a relinquished property addendum.

Getting a copy of the sales contract.

Identifying replacement properties.

Sending to the QI a copy of the sales contract.

Signing an assignment contract for your new property.

Closing on the replacement property.

File the IRS Form 8824.

Conclusion

For an intricate process like that of the 1031 exchange, drawing the 1031 exchange timeline is not only a difficult task but requires complete accuracy. One can achieve this smoothly with the help of tools like EdrawMax Online, which hoists some impactful features like the vector-based dashboard and drag-and-drop dashboard.

Tag

timeline

Share

Report

1

50

Post

Recommended Templates

Loading