Bank of America's SWOT Analysis

Bank of America has been globally leading with its strong suit of consistent business growth and innovation with services and products. Check out Bank of America's SWOT Analysis by EdrawMax.

1. Lead-in

SWOT analysis is a framework that analyzes and identifies an organization's strengths, weaknesses, opportunities, and threats. It deals with the firm's external and internal factors, ultimately leading to future potentialities. SWOT analysis is realistic and fact-based in terms of the strengths and weaknesses of the company. Thus, the company can easily overcome the weakness and threats based on the SWOT analysis.

With the help of the study on the Bank of America SWOT analysis, one can smoothly identify the internal and external factors of the organization. The analysis minutely identifies the firm's strengths and weaknesses. It would instead help to make potential progress in the future. Threats and opportunities are the external factors of SWOT analysis. It helps to understand the threats faced by the bank. Also, it fetches attention towards the opportunities for the bank. SWOT analysis of the Bank of America is essential to lead forward with high potential. In this guide to master SWOT Analysis, we will introduce a free SWOT analysis creator EdrawMax Online that helps create wonderful SWOT analysis diagrams with utter ease.

2. About Bank of America

2.1 Introduction of Bank of America

Established in 1998, Bank of America is one of the world's topmost monetary corporations, serving some private shoppers, market organizations, and reputed companies. In the United States, Bank of America is the largest banking organization. They serve customers in more than 150 nations. Therefore, it is significant to proceed through the SWOT analysis of Bank of America. It helps to identify the internal and external factors of the company. The Bank of America SWOT-analysis helps to understand the firm's strengths and weaknesses.

2.2 Overview of Bank of America

| Name | Bank of America. |

| Founded | 1998. |

| Industries served: | Banking, credit cards, insurance, Mutual Fund, Mortgage loans, and asset management. |

| Geographical areas served: | 35 countries. |

| Headquarters: | Charlotte, North Carolina, US. |

| Current CEO: | Brian Moynihan. |

| Revenue (US$): | $85.52 billion (2020). |

| Profit (US$): | $17.89 billion (2020). |

| Employees: | 200,000. |

| Main competitors: | JPMorgan Chase, Wells Fargo, SunTrust Bank, PNC, and US Bancorp. |

2.3 History of Bank of America

| 1904 | A.P. Giannini initially founded the Bank of Italy in San Francisco. Eventually, the Bank of America was developed. |

| 1958 | The first credit card of the bank, namely, BankAmeriCard was issued. |

| 1968 | The bank was newly named as BankAmerica Corporation and arranged in Delaware. It became a holding organization for the Bank of America NT & SA with other financial franchises. |

| 1983 | The firm purchased Washington State Bank Seafirst Corporation. It was a remarkable date for the interstate merge between the two banks. |

| 1991 | The coast-to-coast operation started first in this bank. |

| 2004 | Acquiring National Processing helped in enlarging the credit card business. |

| 2006 | The bank merged with MBNA Corporation. |

| 2007 | Obtained U.S Trust Corporation, which in turn manages the high rate of investments. |

| 2007 | Bank of America announced a $2 billion repurchase agreement for Countrywide Financial. |

| 2008 | Bank of America announced that it would buy Countrywide Financial for $4.1 billion. |

| 2009 | The bank announced the revival of $20 Billion in aid from the U.S Government and an additional guarantee of $118 billion against the bad asset. |

| 2013 | The Bank was sued by the U.S Government because of financial fraud. |

| 2014 | Bank of America agreed to settle claims against it relating to the sale of toxic mortgage-linked securities. |

| 2018 | Bank of America announced it would expand into Ohio. |

3. SWOT Analysis of Bank of America

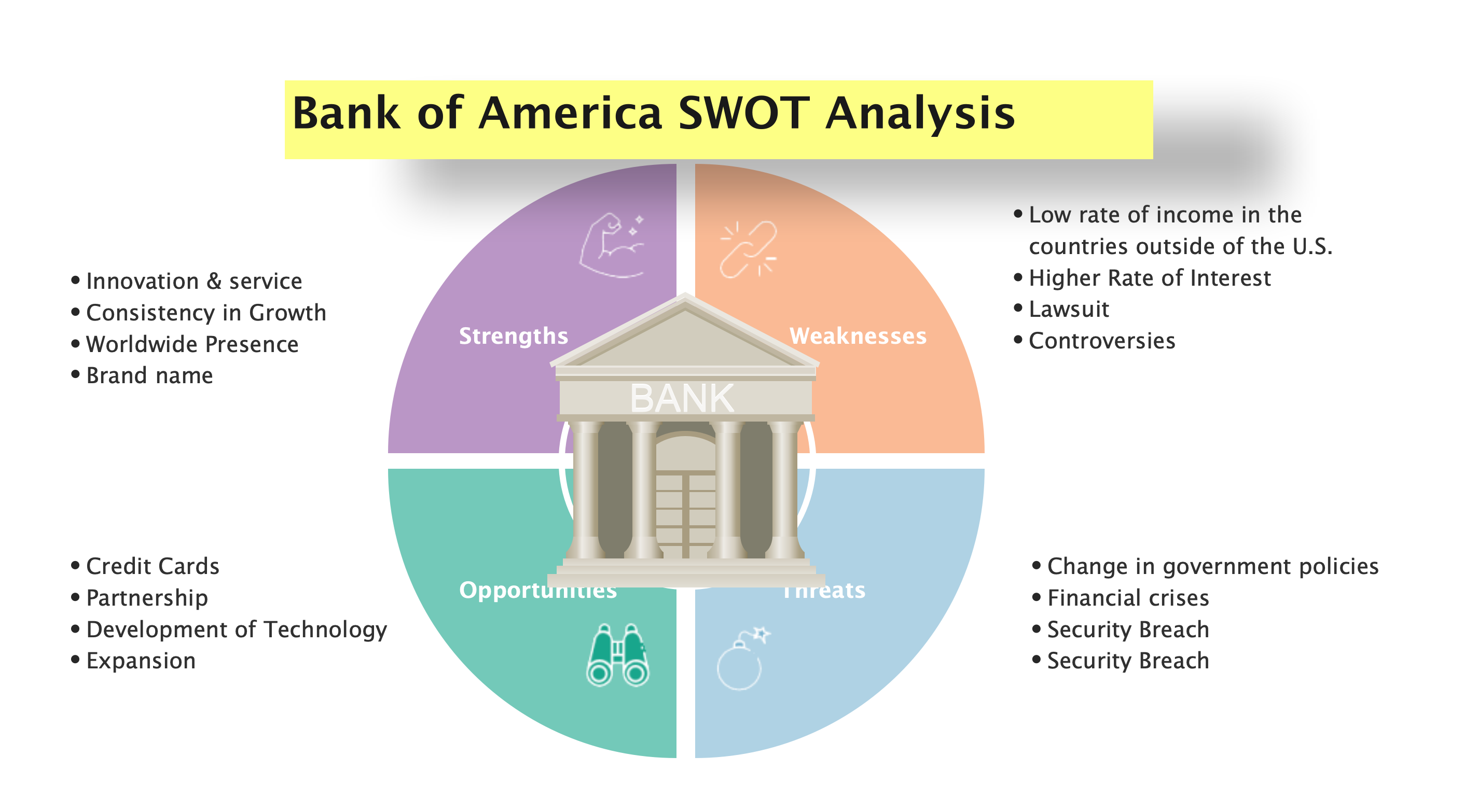

Strengths

Strengths are the internal factors of the organization. It helps to estimate the stronghold of the company within the market. Some of the primary strengths of the Bank of America are as follows:

- Innovation & service: In terms of innovation, Bank of America is at its peak. It provides a massive range of services to meet the demands of the clients. In 2020, Fortune magazine honored the bank as the "Most Inventive Bank in North America."

- Consistency in Growth: Bank of America remained consistent concerning the uprising trend even in the COVID-19 epidemic, whereas yearly sales dropping is being featured aside. Henceforth, the bank sustained the trust of customers and investors.

- Worldwide Presence: Bank of America has a global presence in around 35 counties, apart from the U.S. The company has obtained 3.5 billion dollars from the loan and services acquired globally in 2020.

- Brand name: The bank has the best financial position and a reputed brand name, which works as the company's strength.

Weaknesses

Weaknesses are the internal factors leading to the setback of the organization. The management of the company can identify weaknesses of the company with the help of the SWOT analysis of Bank of America. Following are some of the weaknesses of the company:

- Low rate of income in the countries outside of the U.S: Bank of America gets 90% of its annual revenue from the banks in the United States. They receive only 10% of revenues from worldwide banks. Hence low rates of income occur in other nations.

- Higher Rate of Interest: Most customers believe that the bank incurred a higher Rate of Interest. It is unjustifiable yet true. Hence, this can be a weakness of the organization that can hinder its growth.

- Lawsuit: Bank of America paid a settlement of around 16.65 billion dollars as they failed to overcome the buyback mortgage cost in 2014. In 2021, Bank of America could not secure the accounts of thousands of unemployed. Thus, they faced another lawsuit. It further obstructed the firm's overall growth.

- Controversies: Wikileak's Controversies are affecting the business operation of the bank, thus hindering future growth and development.

Opportunities

Weaknesses are the internal factors leading to the setback of the organization. The management of the company can identify weaknesses of the company with the help of the SWOT analysis of Bank of America. Following are some of the weaknesses of the company:

- Credit Cards: Increasing usage of credit cards and online banking is quite popular nowadays. Most customers value it. Bank of America offers their valuable customers this service. Moreover, they have also facilitated the global utilization of credit cards. It can be an opportunity for the firm to expand.

- Partnership: The bank was formed after collaborating with NationsBank in 1998. Later, in 2004 and 2005, the bank was merged with FleetBoston Financial and MBNA. In 2006, US Trust Company merged with the Bank of America, and in 2007 they had another merger with LaSalle. The bank would continue with this merging with the increase in market share. Thus, creating an opportunity for the organization to expand through partnerships and mergers.

- Development of Technology: The bank has developed technologically. One such technical progress is internet banking, which is increasing among nations. The bank can use it as an excellent opportunity that will help them to expand.

- Expansion: Expansion of the Bank out of the United States of America is another excellent opportunity in terms of geographical expansion of the product and service.

Threats

The threat is the external factor in the SWOT analysis, which is also a negative factor as it indicates competitor activity, changes in government policies and products, and such things. The following are the threats to the Bank of America in the market.

- Change in government policies: The change in government policies can be a possible threat to the company because government policies may be unfavorable for the company's growth.

- Financial crises: It has negatively impacted the company and is a constant threat to its further sustainable growth and development.

- Security Breach: There was a security breach in April 2020 at BoA. It revealed a crucial program, the Paycheck Protection Program. For the first time, the bank database got hacked.

- Competitors: Bank of America's primary competitors include JPMorgan Chase, Wells Fargo, SunTrust Bank, PNC, and US Bancorp. Thus, competing with other banks may incur a loss in market share.

Bank of America's SWOT Analysis Diagram

As you saw here, SWOT analysis is an integral part of any organization's progress as it not only depicts the strengths and weaknesses in detail but also introduces the opportunities and threats it faces. In order to retain the information for a long time, students and professionals are advised to work on a Bank of America SWOT analysis diagram using the astounding customization options offered by EdrawMax.

4. Free SWOT Analysis Diagram Creator

When it comes to creating a SWOT analysis, EdrawMax is your go-to tool. Unlike other SWOT analysis creators, this is a free tool that comes with templates and several customization options. Some of the great features of this free SWOT analysis diagram software are:

- EdrawMax offers a wide range of customization options that helps in creating amazing SWOT analysis diagrams.

- With EdrawMax Online, you can access your remotely stored file and create SWOT analysis diagrams on the go.

- EdrawMax lets you create 280+ diagrams, 3x times more than what Microsoft Visio offers.

- When it comes to EdrawMax, you do not have to worry about the safety and security of your files. All the files in EdrawMax are highly encrypted.

- EdrawMax is an all-in-one diagramming tool that offers free templates, symbols, diagramming components, online resources, and more.

- This free SWOT analysis creator is trusted by over 25 million users and leading brands.

5. Key Takeaways

The SWOT analysis of Bank of America depicts the bank's consistency in growth with innovative services and products. Also, the bank has faced a lot of controversies and lawsuits. The company has proclaimed several opportunities. The bank facilitates its customers with credit cards and internet banking as well. Although, it has a threat from competitors and financial crisis along with the change in government policies.

When it comes to SWOT analysis making, professionals and beginners look for such tools that offer a wide range of options and are affordable. EdrawMax is one such tool that lets you make 280+ diagrams and is trusted by 25 million people worldwide. Download this tool today and start making different SWOT analysis diagrams as per your requirements. You can even check out EdrawMax Online if you prefer working remotely. The online version of this SWOT analysis software offers you several remote functionalities of this diagramming tool, like access to private cloud storage and more.

Reference

-

Swot Analysis 2022 2022. Bank Of America SWOT Analysis [Update 2022] | Swot Analysis 2022., [online]. Available at: https://swotanalysis.website/bank-of-america-swot-analysis/ (Accessed 15 August 2022).

-

IIDE. 2022. SWOT Analysis of Bank of America - 2022 Update | IIDE., [online]. Available at: https://iide.co/case-studies/swot-analysis-of-bank-of-america/ (Accessed 15 August 2022).