Airline Industry Porter's Five Forces Analysis

Want to Create Forces Analysis?

Want to Create Forces Analysis?

EdrawMax is able to create free forces analysis for software development teams with ease. Give it a try!

1. Introduction

Porter's Five Forces encompasses five "factors" of competition that businesses can use to analyze the position of their products or services in the competitive market. Based on the analysis, a company can reduce or improve its profitability and focus on specific areas. Porter's five forces model was devised by Micheal Porter and has been in the market since 1979. In this article, we will analyze Porter's five forces in the airline industry to understand the different dynamics of the airline industry.

2. Background of airline industry

The airline industry is very productive and profitable; hence it faces numerous competitive challenges and threats that can impact the performance and profitability of the players in the industry. The airlines in the market and Investors interested in them can analyze it as a potential investment and conduct a fundamental analysis to gain a clear picture and position of the airline industry. This information supports better investment decisions.

Airline companies vary in their scope. There are international airlines, national airlines, and regional airlines. They have different competitors, and their strategies also differ based on their market.

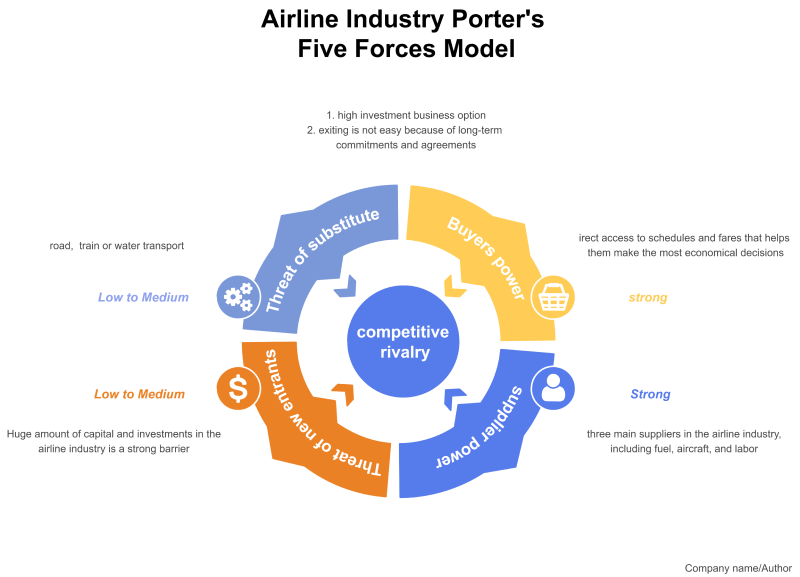

3. Airline industry Porter's Five Forces

Many key aspects of using Porter's Five Forces for the airline industry are passenger traffic, operating expenses, fuel prices, and landing and maintenance costs. Another key factors are competition from low-cost carriers who have initiated the cutthroat price war affecting every player in the market. Let us review Porter's five forces airline industry in detail.

- Competition in the industry(strong force)

- The threat of new entrants (low to medium force)

- The bargaining power of suppliers(strong force)

- The bargaining power of customers(strong force)

- Threat of substitute products or services(medium force)

3.1. Competition in the industry (Strong force)

The airline industry competitors analysis shows that the rivalry in the airline industry is extremely strong based on several reasons. Since it is a high investment business option, the number of competitors is not increasing phenomenally. This industry has entry and exit barriers; companies need substantial investment to vent into this business. Also, exiting is not easy because of long-term commitments and agreements.

So, how can we deduce that the competition in the industry in Porter's five forces model airline industry is strong? It is based on the competition between existing companies and the power of suppliers. The competitive industry competitors analysis shows that no company can count on extra profits and the fares from different airlines are more or less the same. So, they will have to count on more expensive measures to combat this competition.

3.2. The threat of new entrants (low to medium force)

New entrants may use lower pricing by reducing extra costs and offering innovation to put pressure on airline industry. However, this is a low to moderate force in the competition. The entry and exit barriers are moderate, and the initial investment to start a coffee shop is not exuberant. So, locally new entrants have the potential to compete with giants like airline industry. Studying Porter's five forces example, airline industry, we can see that the brand image, brand loyalty, and market share of airline industry can mitigate this risk effectively. It has the infrastructure, efficiency, and very high product quality as its defense against this threat. Exclusive access to raw materials and suppliers is another factor contributing to airline industry ' competitive edge.

3.3. The bargaining power of suppliers (strong force)

The power of suppliers in the airline industry is a strong force in Porter's five forces in the airline industry. There are three main suppliers in the airline industry, including fuel, aircraft, and labor. External factors influence all these because the oil price is fixed based on global fluctuations. The second factor is aircraft companies, and there are two big suppliers, i.e., Airbus and Boeing. So, the bargaining power of these suppliers is very strong. The third factor is labor, which always challenges companies with union politics and demands.

3.4. The bargaining power of customers (Strong force)

The airline industry has always remained very competitive. Still, with the online ticketing and distribution system, customers have direct access to schedules and fares that helps them keep the most economical decisions. The entry of low-cost carriers has also increased the bargaining power of customers in Porter's five forces in the airline industry.

3.5. Threat of substitute products or services(medium force)

There are many alternatives for passengers to replace air travel. They can travel by road, train or water transport. However, air travel is still the best option when time is a factor. So we can conclude that this is a low to medium force. This factor is more impactful in regional travel, where short distance makes road and train travel more economical. In international travel, this factor has a very minimal effect.

4. Strategies for Success

We have studied Porter's five forces for the airline industry, so let us suggest success strategies based on our analysis.

- Cost leadership

- Differentiation

- Focus

4.1. Cost leadership

Cost Leadership strategy is a strategy of reducing the cost of operation to produce the least priced products and services. As we already discussed, there is less room for substantial price hikes in the industry. So, airlines can only minimize costs using economies of scale, efficient utilization of resources, and gain an edge with high-quality services. So, the airline industry can also gain by providing high-quality travel services, loyal customer rewards, more scheduled flights, etc.

4.2. Differentiation

Price is mostly the determining factor for the passengers. However, airlines can take an edge with product distinction and personalization. These products may include a luxury travel experience with more room, better food quality, entertainment services, and others.

4.3. Focus

Focus strategy means identifying a small-scale segment of the market and creating exclusive products or services for them. Airline companies can provide some comfort services for special segments of passengers like women, youth, kids, or elderly. Sometimes, regional airlines can find room for unique geographical routes and special products for their passengers.

5. Bonus: Examples of Strategic Analysis Tools Used in the Airline Industry

The airline industry is a highly competitive market, with airlines competing fiercely on price, schedule, and route network. But what makes a successful airline? Is it a strong brand, a loyal customer base, or a cost-effective operation? The truth is, there is no one-size-fits-all strategy in this industry. Success depends on a variety of factors, both internal and external.Here, you'll explore other analytical frameworks for the airline industry: PESTLE, value chain, SWOT, and VRIO. Check out these pre-designed examples from the Wondershare EdrawMax Templates Community.

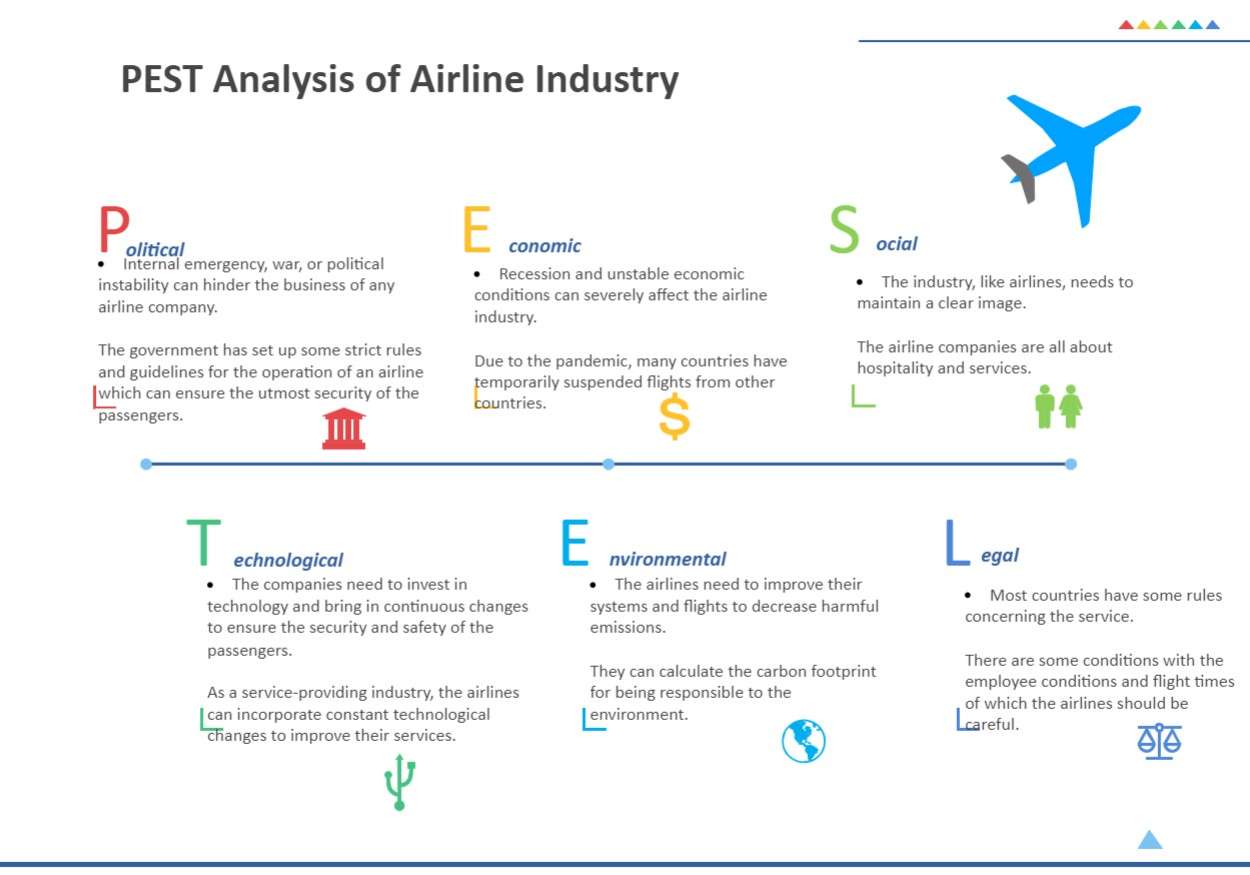

Airline Industry PESTLE Analysis Example

Airlines can use PESTEL analysis to identify and anticipate these external factors. Also, it helps them to develop strategies to mitigate any negative impacts. Political factors include government policies, such as air travel security regulations. Airlines may only be willing to fly there if there is political instability in a particular country.

Economic factors such as a recession can lead to a decline in demand for air travel. Here, airline companies can offer discounts and promotions to attract customers. Social factors, such as the growing popularity of budget travel can also affect the airline industry. And new technologies can have a major impact on the airline industry, such as developing more fuel-efficient aircraft.

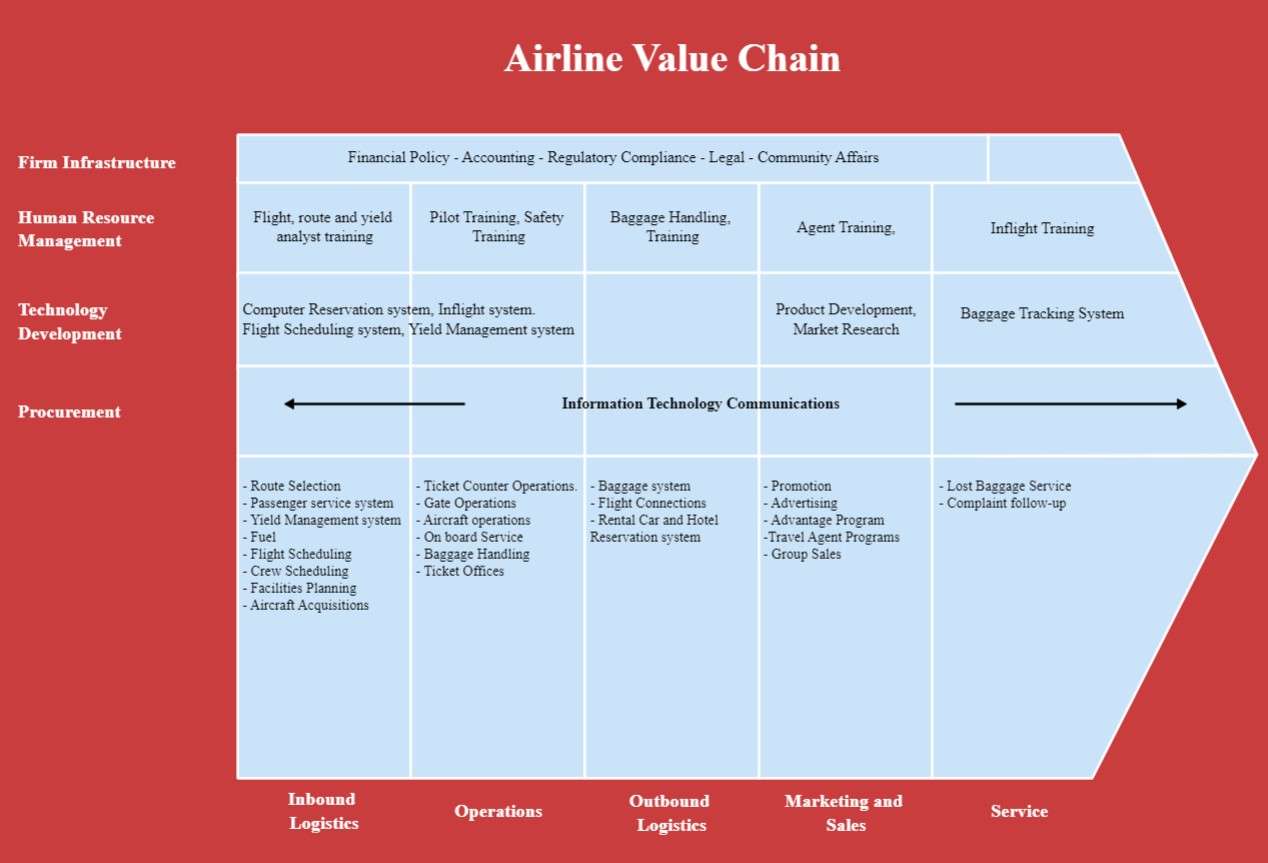

Airline Company Value Chain Analysis Example

Imagine you're planning a trip to Paris. You start by booking your ticket online (inbound logistics). Then, you arrive at the airport and check in. You go through security and board your flight (operations). Onboard, you enjoy a meal and watch a movie (service). After landing, you collect your baggage and exit the airport (outbound logistics).

The airline value chain involves several activities, from planning flights to baggage handling. It includes all the primary and support activities businesses use to produce and deliver their products or services. Each activity in the value chain plays a role in creating value for customers. That includes reducing costs, improving efficiency, or enhancing the customer experience.

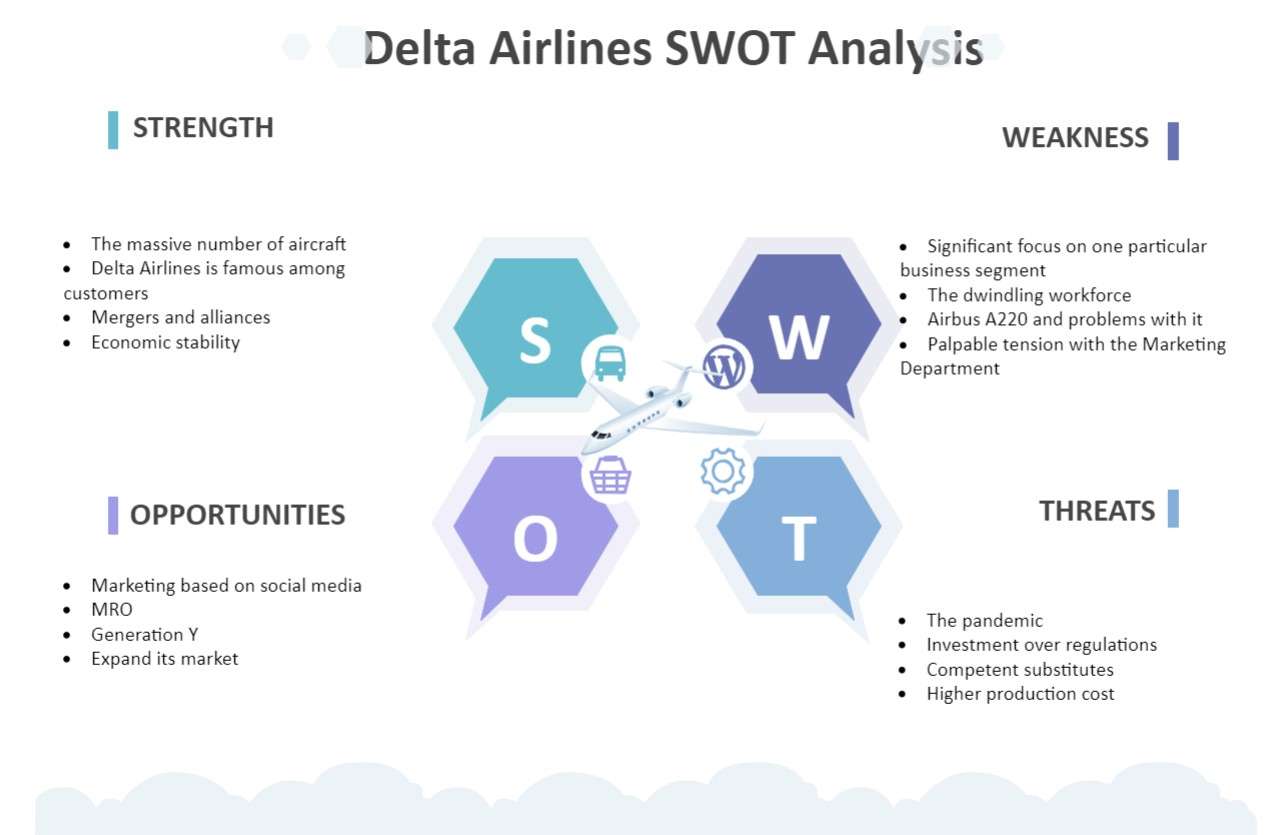

Airline Company SWOT Analysis Example

SWOT analysis is a strategic planning framework for assessing an organization's competitive position. It also helps develop strategies for growth and success. For example, Delta Airlines is one of the leading airlines in the world, with a strong brand reputation. One opportunity that Delta Airlines can leverage is the growing travel demand. It can also partner with local airlines to offer more flights and destinations.

Another opportunity for Delta is the growing popularity of e-commerce. Delta can partner with e-commerce companies to offer package deals that include flights, hotels, and rental cars. Delta can also mitigate its weaknesses and defend against its threats. For example, it can reduce its costs by outsourcing some of its non-core functions.

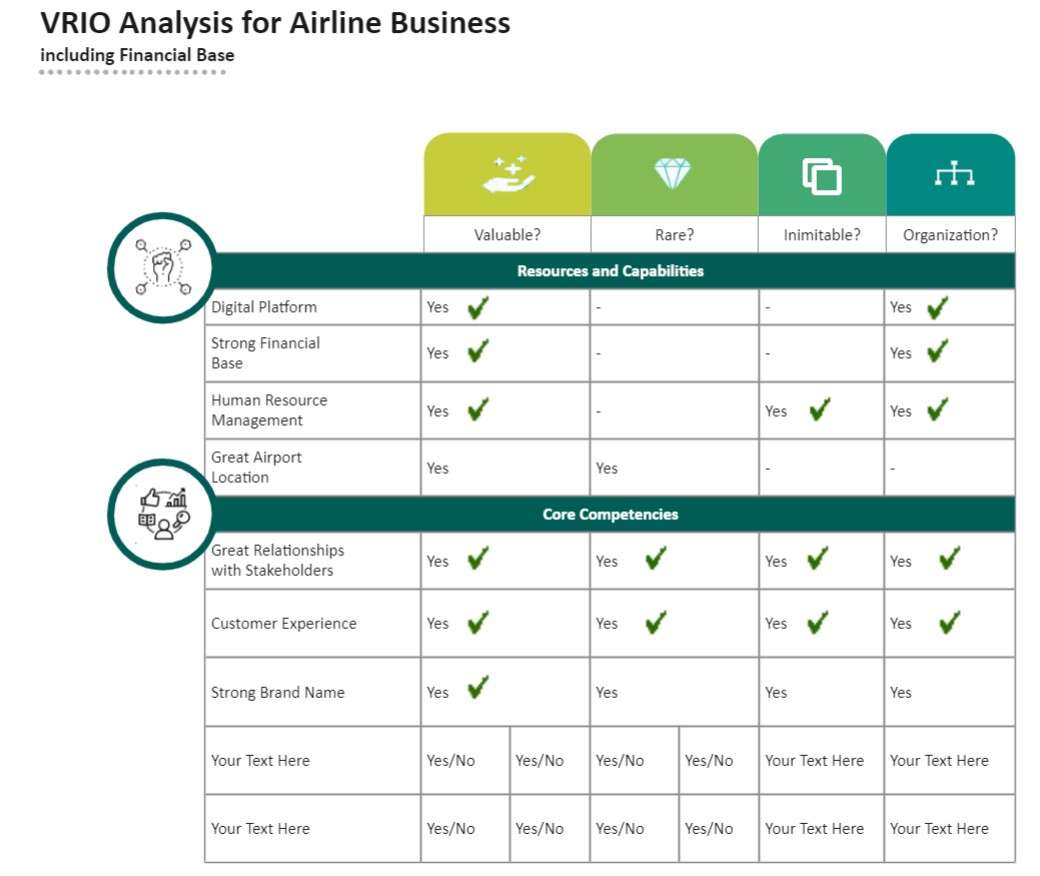

Airline Business VRIO Analysis Example

The VRIO analysis is a framework that businesses use to assess their competitive advantages. It stands for valuable, rare, inimitable, and organized. For example, an airline with a strong financial base could use this to expand into new markets or acquire competitors.

A memorable brand name is valuable, rare, inimitable, and organized for airline businesses. It is valuable because it helps airlines to attract customers and charge higher fares. It is rare because few airlines have a strong global brand reputation. It is inimitable because it is difficult for other airlines to copy a strong brand reputation.

Key Takeaways

1. Airline industry Porter's five forces model shows different forces that act on the players in the airline industry. These forces are competition in the industry, the threat of new entrants, suppliers' bargaining power, buyers' bargaining power, and the threat of substitutes.

2. The airline industry is very competitive, and the bargaining power of suppliers and customers is high. However, the threat of new entrants and substitute products is low to medium.

Using online drawing software is an excellent way to visualize Porter's five forces model to understand different dynamics performing the airline industry. EdrawMax is a suitable candidate with all the supporting tools such as easy layout, a wide range of templates, and well-stocked symbols libraries. Find more Porter’s Five Forces templates.

below.

below.  below.

below.